Mallorca, the largest of the three Balearic Islands in the Mediterranean Sea off the coast of Spain, impresses on the one hand by its Mediterranean landscape and the warm Mediterranean climate, on the other hand by their cultural life. This diversity makes the island popular with anyone who wants to make their leisure time or their vacation stylish and varied. The hills of the island offer the opportunity to go on extended hikes in nature. Numerous bays and beaches invite you to relax in the sun.

The center of the island, Palma de Mallorca, offers exclusive boutiques, cafes and restaurants, the opportunity to get to know the lively side of Mallorca. Both the capital of the island and other places on the west coast of Majorca have marinas where also meet the rich and beautiful. And no matter if you settle down in one of the homes in the posh town of Son Vida, Santa Ponsa or Port Andratx, a golf course is never far away.

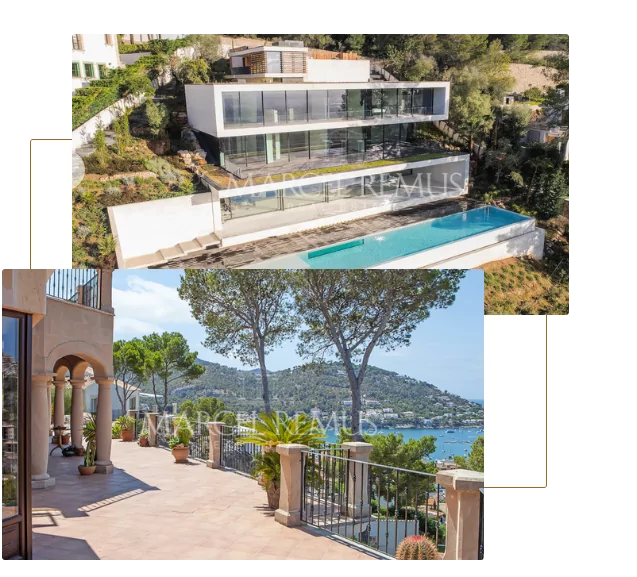

Mallorca's diversity is also evident in the extensive range of residential properties on offer. Whether with a view of the sea or nestled in the rolling hills of the island: Mallorca offers properties and estates in prime locations for the most discerning tastes. Son Vida and Port Andratx are among the most noble residential addresses on the island. All three towns are located on the west coast of the island and offer a pleasant Mediterranean climate even in winter. While Son Vida is located directly on the outskirts of Palma de Mallorca, the island's capital can be reached in a very short time from the other two towns. Those who choose one of the properties in Port Andratx have the mountains and the sea right on their doorstep. The town itself also offers attractive leisure options for every taste: from numerous sights to traditional town festivals and an exclusive marina. An indispensable activity for residents and visitors to Santa Ponsa is a stroll along the seafront promenade. In each of the three towns, there are also various water sports that make a visit to the beach a unique experience. Those who buy property here in Mallorca can enjoy this extensive range of attractions and entertainment every day.

Feel free to use our mortgage calculator and learn more about your options!

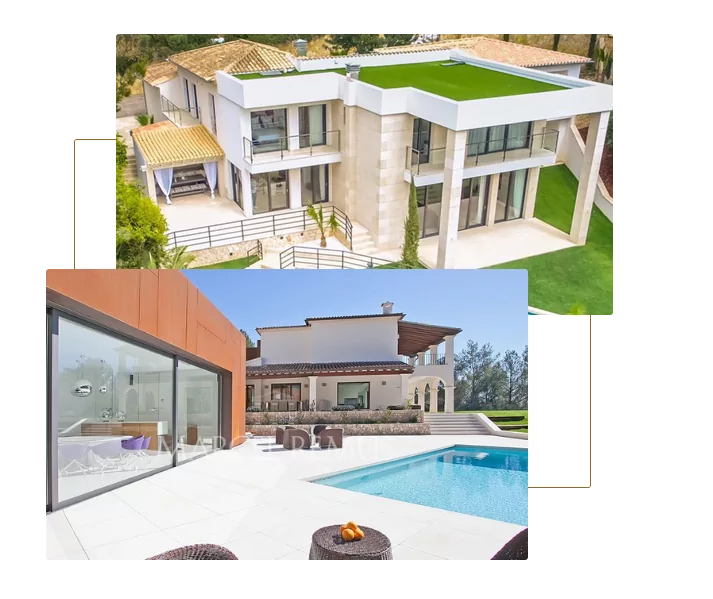

Houses and villas on Mallorca score points for their high quality of stay. With such luxurious Mallorca properties, you can enjoy the summer on well-kept plots with spacious terraces and generous pools. The interiors of the properties are equipped with all imaginable extras and sweeten your everyday life. Purists get their money's worth when buying a house in Mallorca or renting a design villa with upscale luxury furnishings. Large window fronts, geometric shapes and modern materials characterise these architect-designed houses. The charm of Mallorca can be enjoyed in a particularly stylish and authentic way in properties built in the Mediterranean style. The villas and houses on Mallorca always impress with their representative character and thus become an unsurpassable status symbol.

Whether as a holiday home, second home or rental property - buying a house on Mallorca or owning a flat there is a worthwhile investment. All flats are luxuriously furnished, located in Mallorca's best areas and offer many special features. Large sun terraces, unobstructed views of the sea or the rolling hills of Mallorca as well as spacious rooms characterise the flats. The penthouses in particular offer a lot of space and privacy. This exclusive form of top-floor flat is often characterised by terraces all around, which allow an unrestricted view of the surroundings. You will also find luxury flats for rent or sale on Mallorca that are modernly furnished and fully equipped.

Fincas have always characterised the landscape of Mallorca. In the past, these properties were the country residences of farmers and their families, but today they are popular residential properties with a rustic flair for sophisticated tastes. The Mediterranean character of the fincas can be felt both inside the houses and in the outdoor areas with terraces and pools. Historical details such as natural stone masonry, round arches and shutters provide a particularly authentic living feeling. On Mallorca, you can buy lovingly renovated old buildings or newly built fincas.

With fantastic picture galleries, detailed object descriptions and a personal contact we will inform you in detail about our unique luxury real estate in Mallorca.